Striking the League vs. Team Profitability Balance in the NHL

August 17, 2012 Leave a Comment

The NHL is a consortium of individual teams. Each franchise operates with their own ownership and P&L. Thus each franchise tries to maximize their economic return individually, while working in association with the rest of the league as it relates to the players union and other league-wide agreements.

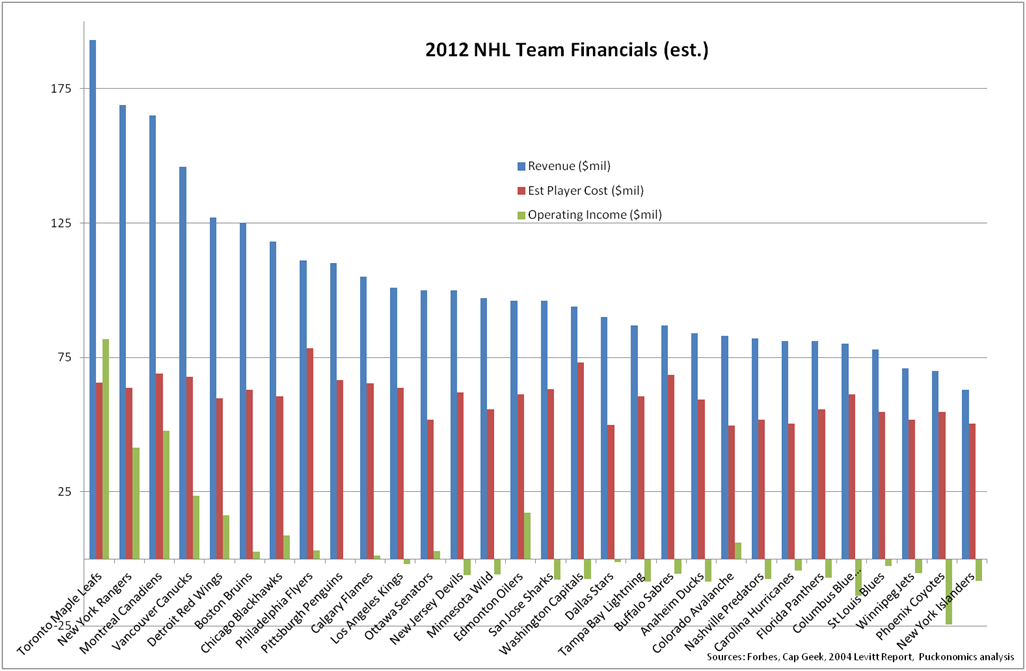

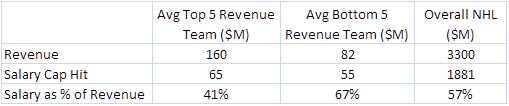

The following graphic shows the core of the fundamental issue between the NHLPA and the NHL. While the league overall makes about $126M and 4.1% operating income which is okay, but not great compared to where they could/should be. However, at the team level, it is nowhere nearly as pretty a picture. As you can see, over two-thirds of the teams are struggling to turn a profit.

Source: Forbes

At the NHL Players Association, it makes sense for them to take a position which puts the onus of finding a solution to this imbalance on the owners and suggest they find new revenue sharing levers amongst themselves. This is why the NHLPA’s counter-proposal had some merit. It suggested that the overall league would become more profitable by allowing revenue growth to outpace player salary growth, thus increasing league-wide margin. As well, they proposed several ideas about how to allow for teams to shift revenue from profitable to unprofitable teams using performance-related financial instruments.

On the other side, from the league and owners perspective, they are trying to make each franchise successful and profitable on their own merits – while maintaining competitive balance with a hard salary cap.

So who is right? Where should the line be drawn for overall league profitability (which it is now) and having the majority of teams being profitable (which they are not)? Removing salary cap restrictions could allow each team to operate profitably, but would remove competitive balance – this option would be more like Major League Baseball and is in line with the NHLPA’s proposals. But the NHL wants all three: league profitability, team profitability AND competitive balance. In order for the NHL and NHLPA to come to an agreement they will need to find a compromise on where this balance is struck.