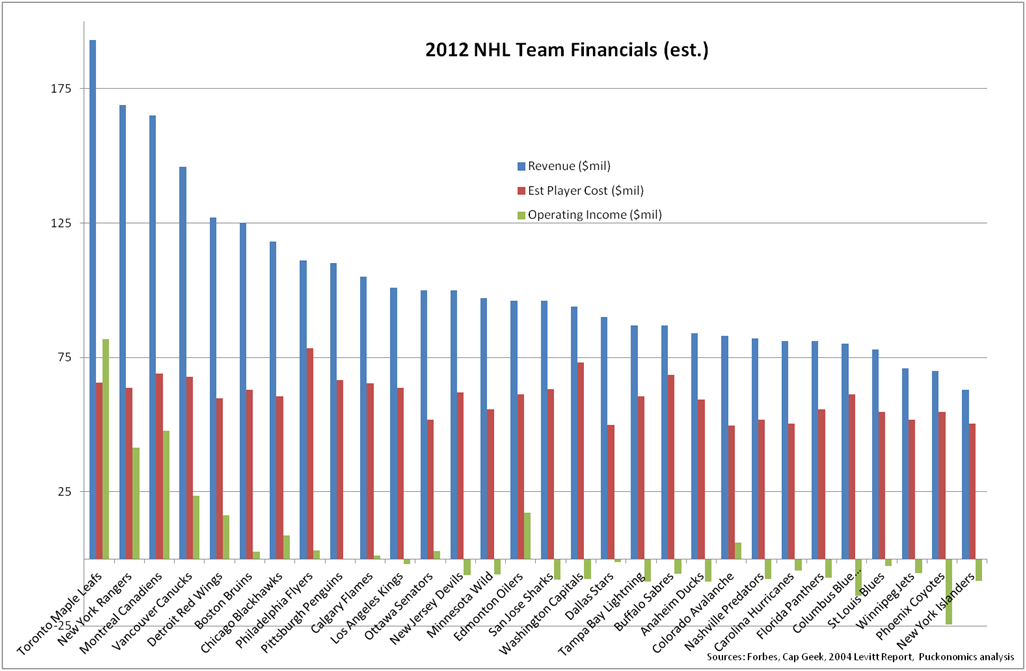

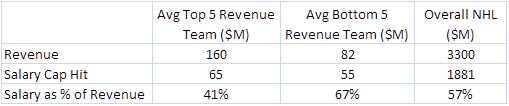

Now that we have looked at the overall league economics and the two ends of the financial spectrum between the Top 5 and Bottom 5 revenue teams, we really need to focus on the teams in the middle.

In portfolio management there are always ‘stars’ and ‘dogs’ but it is the fat middle of teams that really matter. In fact, if you follow the GE/Jack Welch’s low-producing team mantra, the bottom teams are problems that need to be fixed by ownership/management and are not really an issue for the players to solve.

So now, let’s focus on the teams that represent the core of the National Hockey League, the 20 teams in the fat middle. We will refer to them as the “Middle 20”. If the “Middle 20” are not financially healthy given the economic business model that should be associated with a sports league like the NHL, then it makes sense to question the cost structure of the league.

As you can see, even though the salary cap is set at 57% across the entire league, for the ”Middle 20” teams are paying 63% of revenues in salary. And with operating costs estimated to be $37.5 M by our analysis, the average “Middle 20” team is at best breaking even and more likely than not losing money.

So what should the cost structure look like?

Once again we will ignore the Top 5 and Bottom 5 teams and focus on the “Middle 20”. As discussed previously, it should not be unreasonable for these “Middle 20” teams to earn 8-12% operating income. Therefore, a sustainable cost structure could look like this (note this uses 2012 numbers and does not adjust for projected growth in 2012-13):

2011-12 “Middle 20” Economics to get to 8-12% Margins

We are not recommending any specific numbers, just showing a range on how the numbers could work to get to the 8-12% range. If you take the median salary revenue share number of 51% for the “Middle 20” that would make a $49M salary cap hit for these teams. Currently the Top 5 teams spend ~8% more than the “Middle 20”. Assuming the top teams are at the salary cap ceiling, this would make the ceiling at $53M. If you then extrapolate across the league, where you have 30 teams with an average salary cap hit of about $50M you get an effective revenue share rate of about 48.4%. This overall number appears to be somewhat similar to the owners first proposal and may follow some of their rationale. Either way, it is clear the current 57% rate does not appear to be a reasonable rate.

As with any business, ownership must look across all economic levers (both costs and revenue) to improve profitability, so cost savings can clearly be found both in salaries and operating costs. Given that most of these costs are variable in the shorter term it is not unreasonable for each cost center to contribute to finding some savings so that the burden is shared across all parties.