How parity, a hard salary cap and team profitability are the essence of the CBA discussions

September 7, 2012 Leave a Comment

Team owners are just as competitive as the players on the ice. They want their teams to win and will try everything they can within the rules to win the Stanley Cup. At the same time they are business people who must balance the owners’ conundrum. So ironically, league parity is something that each team wants for all the other teams but themselves.

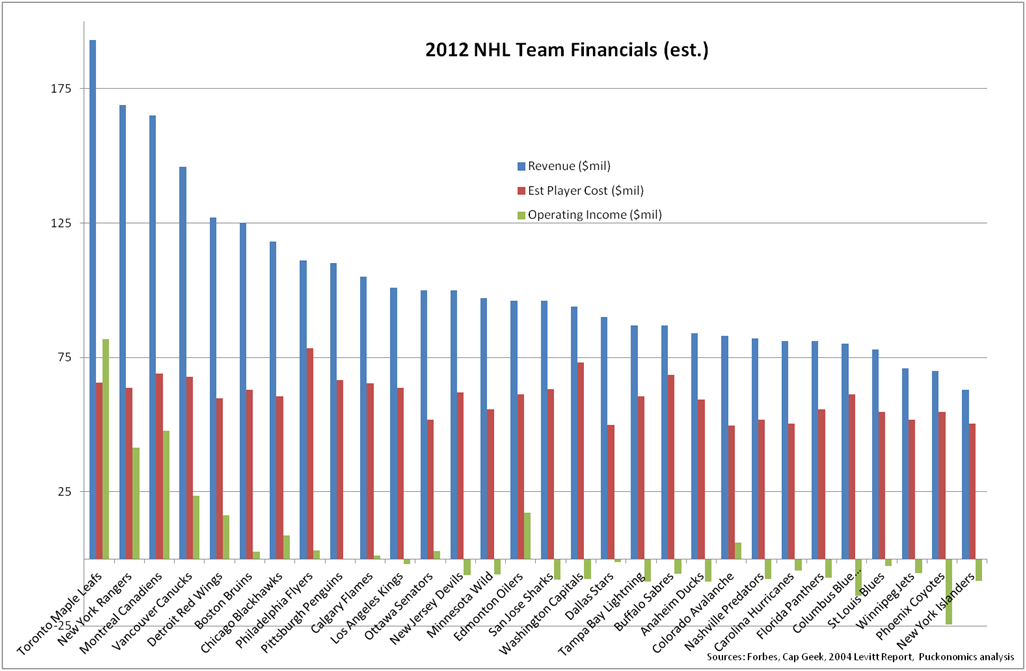

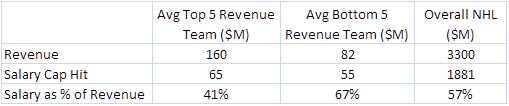

While not the only factor, parity in the NHL has certainly contributed to the tremendous growth of the league in the last few years. With so many teams fighting for a playoff spot going into the final weeks and days of the season this certainly helps each contending team’s ticket sales and viewership. As a result, overall revenues have continued to grow every year.

The league is an ecosystem unto itself, where teams depend on each other’s success to drive interest and revenue. The salary cap created a more even playing field for teams to compete for talent and stay within a reasonable band of each other. As a result we have seen that the salary cap has worked reasonably well the last seven years to create parity.

However, the salary cap is not perfect and several teams have found creative methods to try and circumvent it. Examples include burying contracts in the AHL or Europe, buyouts and trading outsized contracts to budget teams to help them reach the cap floor. There will always be ways to game the salary cap in which richer teams try to take advantage to gain a competitive edge. The NHL wants to close most of these elements which soften the salary cap. Many of the NHLPA proposals such as a luxury tax, retaining traded-player salaries and trading draft picks for cash are all ways to softly loosen the salary cap and reduce parity in the league. Clearly this is in the interest of players because it is then easy to argue that lower revenue teams can now become profitable without dramatically lowering overall salaries. But once again this creates a loose salary cap and is likely to reduce overall competitiveness.

Connecting the dots…

The NHL wants the best of both worlds; overall parity and individual franchise profitability. On the other side of the coin, it is in the players’ interest to have as soft a salary cap as possible since this allows high revenue teams to find ways to spend more on players and try to gain a competitive advantage while staying within the cap rules. The result should see more profitable teams and less of a need to reduce the share of revenue for the players at the expense of the current parity.

Once the owners and players agree upon where to draw the parity vs. team profitability line then determining the revenue share percent for players will become a much easier discussion and move both sides a lot closer to a new CBA.